What fueled their 1M+ emails sent every month?

CreditRegistry's Email Domination Strategy

Industry: Financial Services

Use case: segmentation, onboarding, engagement

BEFORE

- Low campaign engagement: CreditRegistry struggled with low open and click-through rates.

- Limited automations: Manual processes reduced efficiency and hampered user engagement.

- Brand awareness challenges: Reaching and engaging with a large audience was a significant hurdle.

- 50 million messages were sent through emails and SMS catapulting reach and generating 1.1 Million NGR

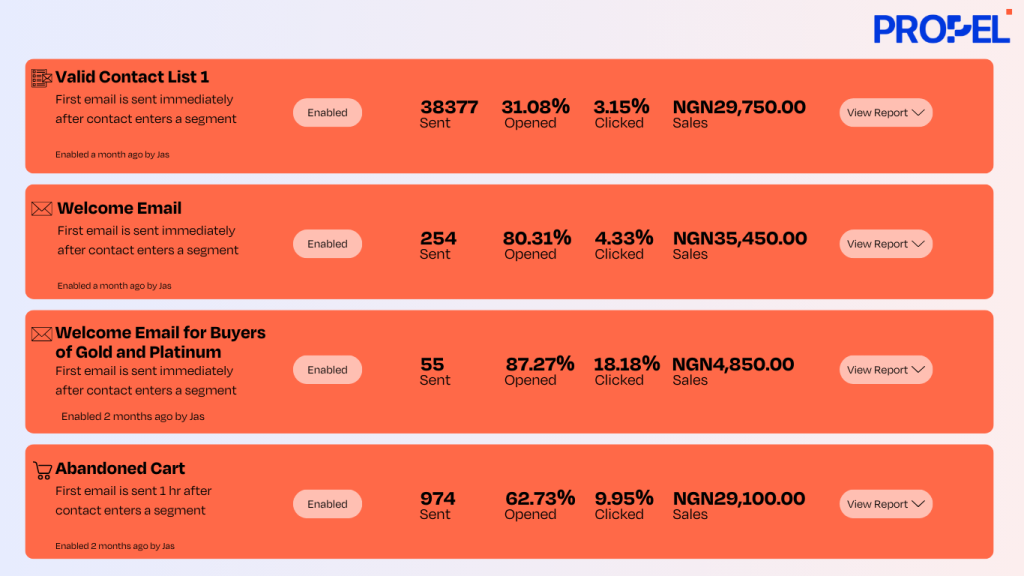

- Automation rates exceeded industry benchmarks, with best-performing automation reaching 87.02% open and 19.35% click rate.

- Welcome emails and cart abandonment reminders boosted engagement and conversions.

AFTER

Table of Contents

CreditRegistry is a Nigerian credit reporting and risk management organization offering a suite of services, including detailed credit reports, credit monitoring, fraud detection, and financial education. Their mission is to promote responsible lending and borrowing by providing accurate credit information to financial institutions, enterprises, and individuals. However, as CreditRegistry scaled operations, it faced several challenges in engaging users effectively and increasing customer retention.

To overcome these issues, Propel leveraged its expertise in Customer Lifecycle Management and advanced automation to design complex, segmented campaigns that aligned with marketing lifecycle stages. Using multiple automation platforms, Propel enabled CreditRegistry to improve user engagement, generate revenue, and build stronger relationships throughout the retention customer journey.

Email campaigns for different customer segments

The Challenge

As CreditRegistry expanded, it encountered specific obstacles that hindered its ability to engage users and generate revenue:

- Choosing the right marketing channels: The company needed to identify the most effective platforms to reach a broad audience and achieve desired outcomes.

- Executing personalized campaigns: Designing campaigns that resonated with diverse target audiences and increased conversions was essential for success.

- Managing automations across multiple platforms: CreditRegistry needed seamless execution of automated campaigns aligned with different marketing lifecycle stages, such as onboarding, engagement, and retention.

- Engaging with 10 million users: The goal was to send “10 million” emails via EmailOctopus (integrated with Amazon SES) and “50 million” SMS through Dotgo Konnect to enhance brand awareness and drive revenue.

- Tracking and optimizing performance: To achieve continuous improvement, CreditRegistry needed a way to monitor user interactions across the entire customer journey and automate responses based on specific actions.

The Solution

Propel adopted a data-driven approach to align CreditRegistry’s marketing efforts with the appropriate marketing lifecycle stages. This involved designing and executing automated flows across three platforms: Omnisend, EmailOctopus, and Dotgo Konnect.

- Automating Campaigns Using Omnisend

To create personalized and segmented campaigns, Propel set up CreditRegistry’s Omnisend account and:

- Segmented the audience based on various triggers, including cart abandonment, user purchases, and sign-ups for different credit reports (e.g., Gold or Platinum packages).

- Developed email templates for multiple customer journey touchpoints, such as welcome emails, cart abandonment reminders, and onboarding messages.

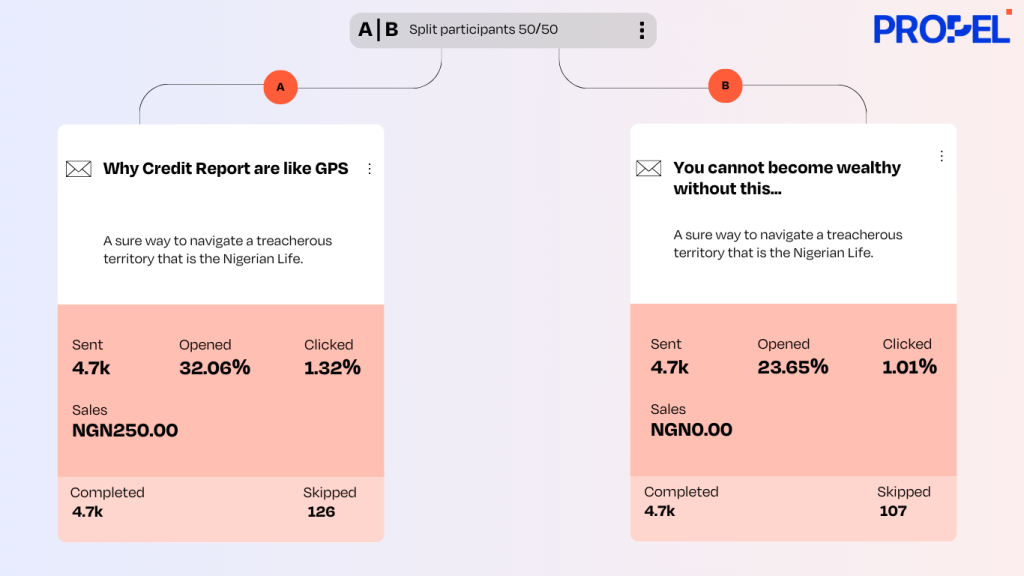

- A/B tested subject lines to optimize engagement, ensuring that each automation delivered the highest open and click-through rates.

- Launched automations to trigger emails when users took specific actions, such as adding a product to the cart without completing the purchase.

- Monitored performance weekly, using data insights to optimize campaigns and improve customer retention.

A/B testing newsletters with different mail copies, each receiving different engagement rates.

- Executing Email Campaigns Using EmailOctopus and Amazon SES

Propel ensured seamless email distribution by integrating EmailOctopus with Amazon SES.

- Imported contact lists and ran test emails to validate automation setups.

- Created automation workflows with specific triggers, sending emails when users were added to target lists.

- Measured open and click rates to identify which subject lines performed best.

- Used performance data to provide actionable insights, refining campaigns to align with each marketing lifecycle stage.

- Enhancing SMS Campaigns with Dotgo Konnect

Propel also helped CreditRegistry expand its SMS outreach to 50 million users through Dotgo Konnect.

- Set up a transactional account, added funds, and applied for a sender mask to ensure branded messaging.

- Designed and published SMS campaigns for brand awareness, sales generation, and traffic growth.

- Continuously measured campaign performance, making adjustments to maximize engagement and customer retention.

Conclusion

By aligning campaigns with specific marketing lifecycle stages and utilizing advanced automation tools, Propel enabled CreditRegistry to enhance engagement, increase customer retention, and achieve its revenue goals. The combination of Omnisend, EmailOctopus, and Dotgo Konnect allowed CreditRegistry to effectively manage the retention customer journey and automate communications throughout the Customer Lifecycle Management process.

Propel’s data-driven approach ensured that CreditRegistry could continuously measure and optimize performance, resulting in higher open and click rates, improved engagement, and increased revenue. Moving forward, CreditRegistry is well-positioned to maintain its momentum by leveraging these insights and strategies to build long-term relationships with its customers and achieve sustainable growth.

This case study highlights how Propel’s expertise in marketing lifecycle stages and customer journey automation empowered CreditRegistry to meet its objectives, overcome operational challenges, and drive meaningful results.

Customer Spotlight

Propel was with us from day one. They guided us through choosing the right tools and stuck around as we scaled up to over a million emails a month. Their expertise really showed in how they handled our lifecycle marketing and mapped out customer journeys.

Taiwo Ayedun

Fouder, CreditRegistry

Explore Success with

- Financial Services

What fueled their 1M+ emails sent every month?…

What led to the 53% improvement in onboarding?…

The secret behind achieving a 60% email success?…

What fueled their 1M+ emails sent every month?…

What led to the 53% improvement in onboarding?…

The secret behind achieving a 60% email success?…